Embark on the journey of understanding How to Form an S Corp with LegalZoom: Pros, Cons, and Costs. This introductory paragraph aims to draw in the readers with a glimpse of what's to come, blending a casual formal language style that unfolds intriguingly.

The following paragraph will delve into the specifics of the topic, providing a comprehensive overview.

Overview of S Corporations

An S Corporation, or S Corp, is a type of business entity that elects to pass corporate income, losses, deductions, and credits through to their shareholders for federal tax purposes. This allows S Corps to avoid double taxation on profits, as income is taxed only at the shareholder level.

Benefits of Forming an S Corp

- Pass-through taxation: S Corps avoid double taxation by passing income to shareholders.

- Liability protection: Shareholders have limited liability for the company's debts and obligations.

- Investment opportunities: S Corps can attract investors by offering shares of stock.

Limitations of Forming an S Corp

- Restrictions on ownership: S Corps have limitations on the number and type of shareholders.

- Operational formalities: S Corps must adhere to certain formalities, such as holding regular meetings and keeping detailed records.

- Tax implications: Shareholders may face tax consequences if the company's profits are not distributed as dividends.

Scenarios where Forming an S Corp is Advantages

- Small businesses looking to avoid double taxation and pass income through to shareholders.

- Companies seeking limited liability protection for shareholders while still maintaining the benefits of a corporate structure.

- Entrepreneurs aiming to attract investors through the sale of stock in the company.

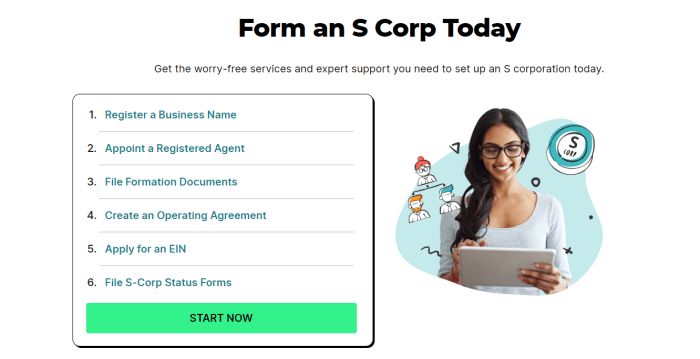

LegalZoom’s S Corp Formation Service

When it comes to forming an S Corporation, many entrepreneurs turn to LegalZoom for their convenient online services. LegalZoom simplifies the process of setting up an S Corp by providing step-by-step guidance and handling the necessary paperwork.

Process of Forming an S Corp with LegalZoom

When using LegalZoom to form an S Corporation, you typically start by providing information about your business, such as the name, location, and shareholders. LegalZoom will then prepare and file the required documents with the state on your behalf. They also offer additional services like obtaining an EIN (Employer Identification Number) for your corporation.

Cost Comparison

Forming an S Corp with LegalZoom can be more cost-effective compared to hiring a traditional attorney or using other business formation services. While exact costs may vary depending on the state and additional services chosen, LegalZoom generally offers transparent pricing without hidden fees.

On the other hand, going the traditional route of hiring a lawyer can be significantly more expensive, as attorneys typically charge hourly rates for their services. LegalZoom provides a more affordable alternative for entrepreneurs on a budget.

Convenience and Drawbacks

One of the main advantages of using LegalZoom is the convenience it offers. You can complete the entire process online from the comfort of your home or office, saving time and eliminating the need for in-person meetings. LegalZoom also provides ongoing support and compliance reminders to help you stay on track with important deadlines.

However, one potential drawback of using LegalZoom is the lack of personalized legal advice. While they can assist with the paperwork and filing process, they cannot provide tailored legal guidance for your specific business needs. This may be a concern for entrepreneurs who require more customized assistance.

Pros of Forming an S Corp with LegalZoom

When considering the advantages of forming an S Corp with LegalZoom, there are several key benefits to keep in mind. LegalZoom offers a streamlined process for creating an S Corporation, making it easier and more accessible for entrepreneurs and business owners.LegalZoom simplifies the paperwork and filing process by providing easy-to-follow instructions and templates.

This can save you time and reduce the likelihood of errors in your S Corp formation documents. Additionally, LegalZoom offers personalized support from experts who can answer your questions and provide guidance throughout the process.

Advantages of Using LegalZoom for S Corp Formation

- Convenience: LegalZoom's online platform allows you to complete the S Corp formation process from the comfort of your own home or office, without the need for in-person meetings or appointments.

- Cost-effective: LegalZoom offers transparent pricing for their services, allowing you to know upfront what to expect in terms of costs for forming your S Corporation.

- Expert Guidance: LegalZoom provides access to legal professionals who can help you navigate any complexities or uncertainties that may arise during the formation process.

Cons of Forming an S Corp with LegalZoom

While LegalZoom offers convenience and affordability, there are potential drawbacks to consider when using their services for S Corp formation.

Limited Legal Guidance

When forming an S Corp through LegalZoom, you are essentially navigating the process on your own. LegalZoom provides document preparation services but does not offer personalized legal advice. This lack of tailored guidance could lead to oversights or mistakes in your formation documents.

Complex Situations

In cases where your business structure or circumstances are complex, using LegalZoom alone may not be sufficient. Legal professionals can offer insights and expertise to address intricate issues that online services may not cover adequately.

Legal Compliance Risks

Without the direct oversight of a legal professional, there is a risk of non-compliance with state regulations or requirements for S Corp formation. LegalZoom's general templates may not always align perfectly with the specific laws of your state.

Limited Review Process

LegalZoom's review process primarily focuses on completeness and spelling errors, rather than ensuring the accuracy or suitability of the content for your unique situation. This could result in oversights that may have legal ramifications down the line.

Costs Involved in Forming an S Corp with LegalZoom

![5 Advantages of S Corporations [INFOGRAPHIC] – The Incorporators 5 Advantages of S Corporations [INFOGRAPHIC] – The Incorporators](https://legal.harianterbit.com/wp-content/uploads/2025/10/S-Corporation.png)

When it comes to forming an S Corp with LegalZoom, it's essential to consider the costs involved. Understanding the fees associated with this process, comparing them with other methods of S Corp formation, and being aware of any hidden fees or additional expenses are crucial for making an informed decision.

Breakdown of Fees

- LegalZoom charges a filing fee, which varies depending on the state where the S Corp is being formed. This fee typically ranges from $49 to $149.

- Additionally, LegalZoom offers different packages with varying services included, such as obtaining an Employer Identification Number (EIN) or drafting corporate bylaws. These packages can range from $329 to $719.

Cost Comparison

- Compared to hiring a traditional attorney to assist with S Corp formation, LegalZoom's fees are generally more affordable. Attorney fees can range from $1,000 to $2,500 or more.

- However, some online competitors may offer similar services at lower costs, so it's essential to research and compare prices before making a decision.

Hidden Fees and Additional Expenses

- While LegalZoom is transparent about its fees, there may still be additional expenses to consider. For example, expedited filing fees, state-specific requirements, or maintenance costs after the initial formation can add to the overall expenses.

- It's crucial to read the terms and conditions carefully and ask questions to ensure you have a complete understanding of all potential costs involved in forming an S Corp with LegalZoom.

Closing Summary

Concluding our discussion on How to Form an S Corp with LegalZoom: Pros, Cons, and Costs, this final paragraph wraps up the key points in a captivating manner, leaving a lasting impression on the readers.

FAQ Section

What is the tax advantage of forming an S Corp with LegalZoom?

When you form an S Corp with LegalZoom, you can benefit from pass-through taxation, where the company's profits are passed to shareholders and taxed at individual rates.

Can I convert my existing business to an S Corp through LegalZoom?

Yes, LegalZoom offers services to help convert existing businesses to an S Corp, making the process smoother and convenient.

Are there any ongoing maintenance requirements for an S Corp formed with LegalZoom?

After forming an S Corp with LegalZoom, you will need to adhere to ongoing compliance requirements such as holding regular meetings and maintaining proper records.

Does LegalZoom provide support for obtaining an Employer Identification Number (EIN) for the S Corp?

Yes, LegalZoom typically assists in obtaining an EIN for your S Corp as part of their services, streamlining the process for you.

![5 Advantages of S Corporations [INFOGRAPHIC] – The Incorporators](https://legal.harianterbit.com/wp-content/uploads/2025/10/S-Corporation-750x375.png)